Lake Zurich’s Kemper Lakes Business Center Sells for $190M Suburban Office Record

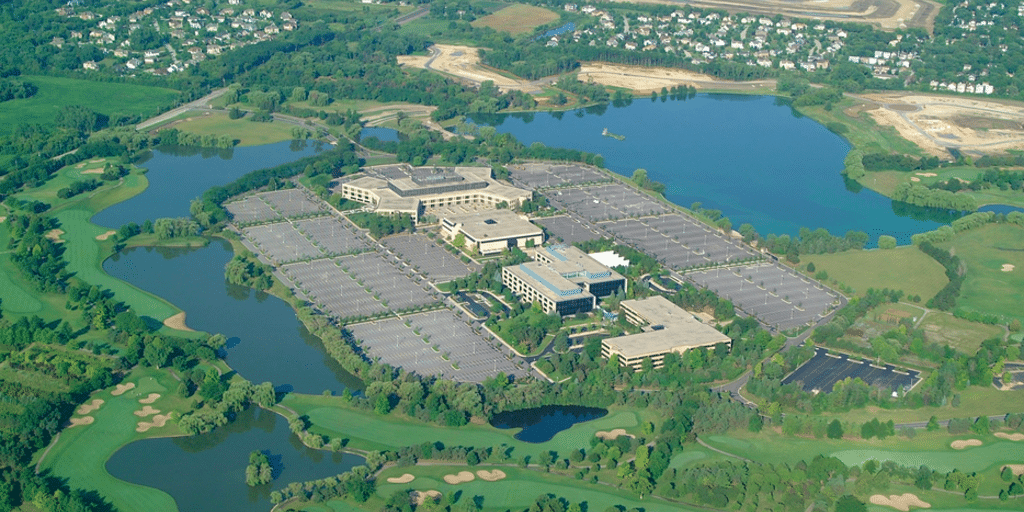

The recent $190 million sale of the Kemper Lakes Business Center in Lake Zurich marks a pivotal moment for the suburban Chicago office market. Spanning 164 acres and nearly 1.1 million square feet, this transaction stands out as the highest-priced suburban office deal since 2005, signaling a renewed investor appetite for office properties with long-term, stable income streams. The acquisition by Northeast Capital underscores the ongoing value that well-leased office assets bring, even as the broader office market faces headwinds due to changing workplace dynamics.

Located near the Kemper Lakes Golf Club, the Kemper Lakes Business Center is a prime example of the kind of office property that continues to attract significant interest from investors. Its appeal lies in its impressive occupancy rate, with 94% of the campus leased to major, long-term tenants. These include German drugmaker Fresenius Kabi, which holds a 355,000-square-foot lease through 2034, Dovenmuehle Mortgage with a lease extending to 2032, and office supply giant Acco Brands leasing 189,000 square feet through 2030. The strength and stability of these tenants make the property a sound investment, providing Northeast Capital with reliable and predictable income over the long term.

For commercial real estate agents in Lake Zurich and the surrounding area, this sale exemplifies the kind of asset that remains attractive even amid broader market uncertainties. The suburban office market has faced challenges in recent years, with rising vacancy rates driven by the shift to remote and hybrid work. According to industry data, Chicago’s suburban office market has experienced a net loss of around 3 million square feet of tenants since the onset of the pandemic, pushing vacancy rates to a record 27%. In this context, properties like the Kemper Lakes Business Center, with their strong occupancy and long-term leases, stand out as resilient investments.

This transaction also highlights a broader trend within the office market: the demand for properties that offer stability and predictability in terms of cash flow. Investors are keenly focused on assets with long-term tenants who have strong credit, and they are willing to pay a premium for such properties. For commercial real estate agents in Lake Zurich, this creates a compelling case for promoting well-leased office assets as high-value investments, even in a market that remains in flux.

The significance of this sale extends beyond its impressive price tag. It underscores the value of strategic property management and tenant retention. The previous owners invested heavily in capital improvements and tenant retention strategies, ensuring that the campus remained an attractive and stable location for major businesses. This approach paid off handsomely, both in terms of the property’s sale price and its appeal to investors seeking a reliable return on their investment. For those involved in commercial property management, the lessons are clear: proactive property enhancements, strong tenant relationships, and a focus on stability can significantly boost a property’s value.

Lake Zurich, as a location, stands to benefit from this high-profile sale. The presence of such a major office campus with stable tenants reflects positively on the local commercial real estate market, enhancing the village’s appeal to businesses and investors alike. Commercial real estate agents in Lake Zurichcan leverage this high-profile sale to attract additional investment, drawing attention to the village as a prime location for businesses seeking stability and growth opportunities.

This transaction follows another significant suburban office sale in Deerfield, indicating that while challenges remain, there is still strong demand for office properties that offer stability. For the commercial real estate community, these deals represent a vote of confidence in the suburban office market’s potential. As work patterns continue to evolve, properties with strong fundamentals and high occupancy rates offer a blueprint for success, demonstrating that strategic investments can yield substantial returns even in a shifting landscape.

In summary, the sale of the Kemper Lakes Business Center in Lake Zurich serves as a testament to the enduring value of well-leased office properties. It highlights opportunities for commercial real estate agents to position similar assets as attractive investments and underscores the potential for strategic development and management to create long-term value. This sale is more than just a record-breaking deal; it is a reflection of the resilience and potential of the suburban office market, even in challenging times.