Illinois Science & Technology Park Building Sells For Major Discount

Turning Point in the Lab and Life Sciences Market?

The life sciences sector has been a darling of commercial real estate in recent years. Fueled by venture capital, pharmaceutical advancements, and pandemic-era biotech breakthroughs, lab spaces and life science developments have seen a meteoric rise in demand. However, recent market signals suggest the sector might be approaching a turning point, with oversupply becoming a growing concern in some markets.

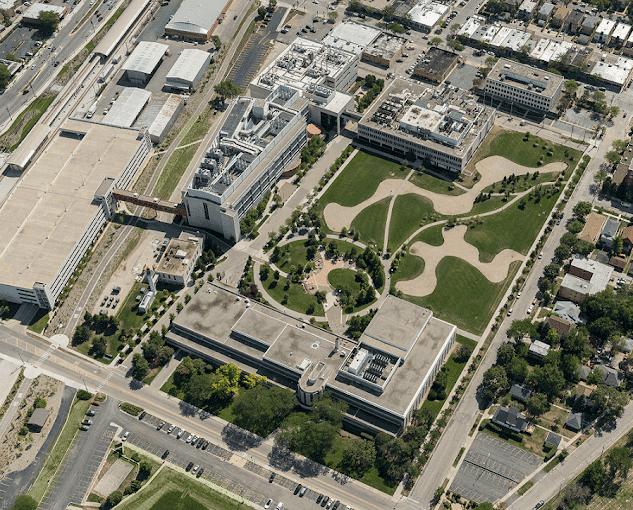

A prime example of this shift can be seen in Singerman Real Estate’s recent acquisition of a life science building in Skokie, Illinois. Purchased at a significant discount from its previous valuation, the deal highlights potential challenges in the lab and life sciences market, particularly in secondary markets like the Midwest.

A Sector Once Immune to Downturns

Over the past decade, the life sciences market has been largely immune to the fluctuations that plagued other commercial real estate sectors. Investors eagerly poured capital into lab developments, betting on sustained demand from biotech firms, pharmaceutical giants, and startups seeking cutting-edge facilities. Prime markets like Boston, San Francisco, and San Diego led the charge, but secondary markets such as Chicago and Raleigh-Durham began attracting attention as companies looked for more affordable options.

The pandemic further accelerated this trend. The urgent need for vaccines, therapeutics, and diagnostics brought billions of dollars in government funding and private investment into the sector. As a result, lab spaces were snapped up quickly, and developers scrambled to repurpose office buildings into life science facilities.

Market Saturation and Overbuilding

While demand for lab space remains strong in core markets, the sector may be facing oversupply in some secondary markets. Developers who rushed to convert office buildings into lab spaces during the pandemic may now find themselves with vacant or underutilized properties. In certain regions, the supply of lab space is outpacing demand, leading to longer lease-up periods and increased competition among landlords.

In markets like Chicago, this oversupply is compounded by competition from more established life science hubs. Biotech firms and startups often prefer to be near established ecosystems with access to top-tier talent, funding, and resources. As a result, secondary markets may struggle to fill new lab spaces, which could weigh on valuations and hinder new development projects.

A Balanced Outlook for Investors

Despite these concerns, there are reasons to remain cautiously optimistic. For well-capitalized investors, the current environment may present unique opportunities to acquire high-quality assets at more favorable valuations. While facing temporary headwinds, the life sciences market is underpinned by strong long-term fundamentals, including an aging population, advances in biotechnology, and the ongoing need for innovative healthcare solutions.

Singerman’s Skokie acquisition underscores the importance of strategic investment. By acquiring the asset at a discount, the firm is positioning itself to capitalize on a potential market recovery. However, success in this sector will require patience, disciplined underwriting, and a deep understanding of market dynamics.

The Path Forward

As the life sciences market enters a more measured phase of growth, developers and investors must remain vigilant about oversupply risks. Careful market analysis, strategic partnerships, and a focus on core, high-demand locations will be critical to navigating this period of adjustment. While some secondary markets may face challenges in the near term, the sector’s long-term outlook remains positive.

The current market conditions serve as a reminder that even robust sectors like life sciences are not immune to cyclical pressures. By approaching the market with caution and a strategic mindset, stakeholders can position themselves for success as the industry continues to evolve.