Future-Proofing Industrial Investments for the Energy Needs of the Future

Introduction

As industries embrace automation, artificial intelligence (AI), and advanced manufacturing, power demand is set to increase dramatically. The shift toward robotics, language-based AI models, and high-performance computing places new pressures on energy infrastructure. Industrial investors must prepare for this transformation by considering energy resilience, sustainability, and cost efficiency. This article explores future energy demands, risks, and opportunities for investors, specifically focusing on nuclear energy as a potential solution.

The Rising Power Demands of AI and Robotics

AI and Data Centers

Artificial intelligence, especially large language models (LLMs) like OpenAI’s ChatGPT, Grok, and Google’s Gemini, are incredibly power-intensive. According to a study published in Nature Energy (2023), AI-driven data centers could require up to 500 terawatt-hours (TWh) annually by 2030—equivalent to the entire electricity consumption of Sweden.

The rapid expansion of AI applications—from automated supply chain management to factory predictive maintenance—exacerbates this trend. Semiconductor manufacturing, necessary for AI chip production, further increases demand. NVIDIA, a leader in AI hardware, reported that data center energy consumption is growing at 70% annually.

Robotics in Manufacturing and Logistics

The deployment of industrial robotics is similarly straining power grids. According to the International Federation of Robotics (IFR), global robot installations reached 517,385 units in 2023, a 31% increase from 2022. Depending on its function, each robotic unit consumes between 5 and 15 kWh per hour. When scaled across entire facilities, energy demand becomes substantial.

Automated warehouses, such as those operated by Amazon and Tesla, rely on fleets of mobile robots, increasing power needs further. A McKinsey report (2024) projects that by 2035, energy consumption from robotics in logistics alone will exceed 600 TWh annually.

The Grid’s Growing Inadequacy

Current energy infrastructure struggles to keep pace with these demands. The U.S. power grid, primarily designed in the mid-20th century, faces significant reliability concerns. The North American Electric Reliability Corporation (NERC) reports that by 2030, peak demand could outstrip supply by 12% if no significant grid investments are made.

The Case for Nuclear Energy

Reliability and Baseload Power

Unlike renewables such as wind and solar, nuclear power provides consistent, 24/7 baseload energy. Nuclear energy offers a distinct advantage as AI and robotics require uninterrupted power. According to the International Energy Agency (IEA), nuclear plants operate at a capacity factor of 92.5%, compared to 35% for wind and 25% for solar.

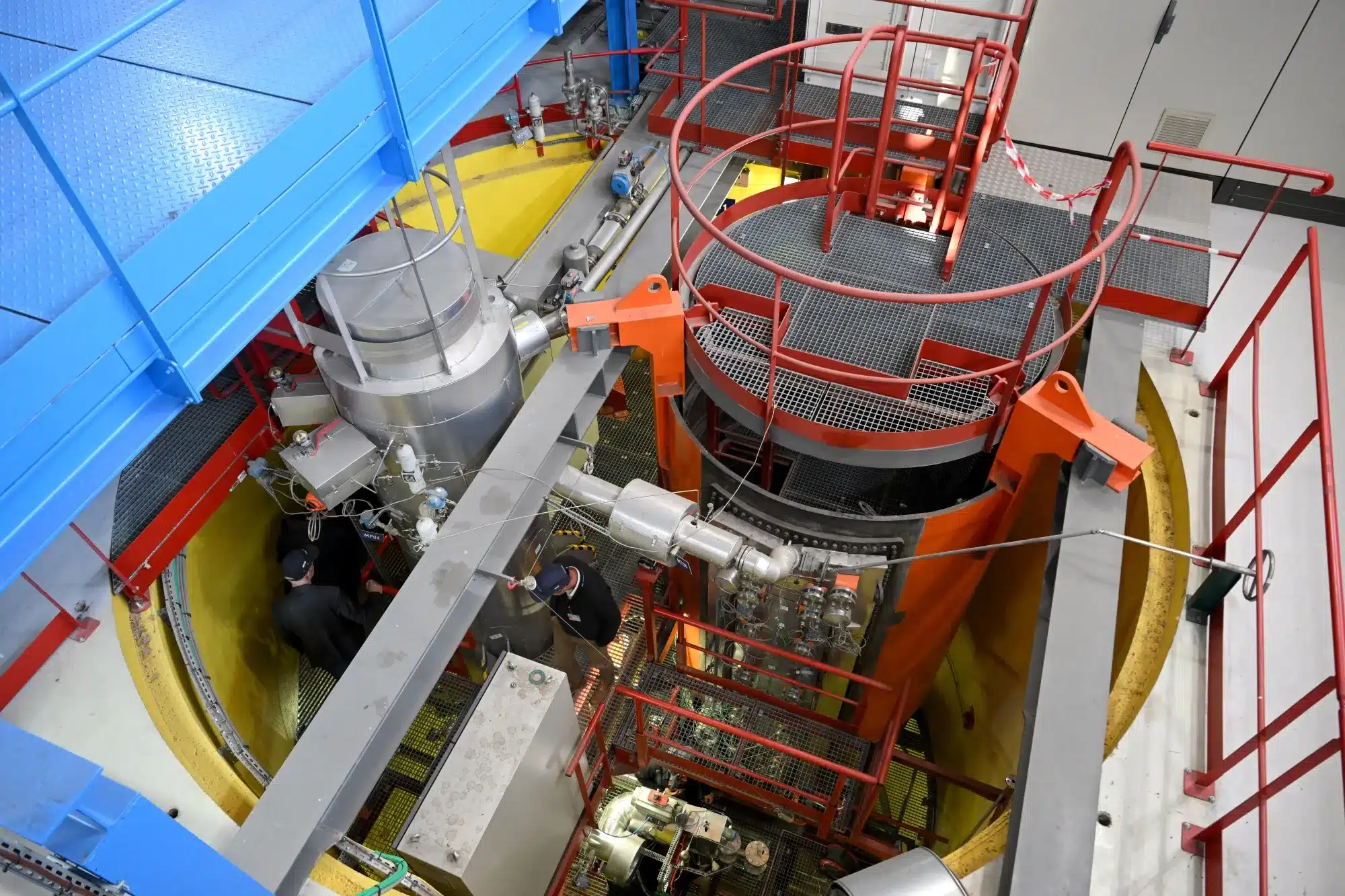

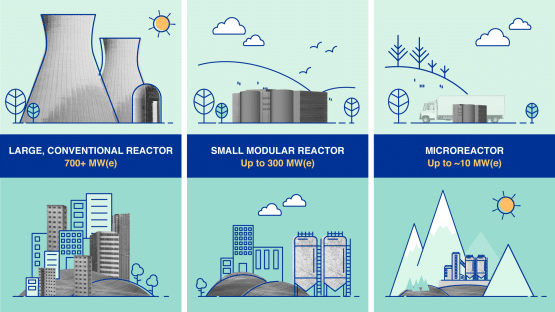

Small Modular Reactors (SMRs)

A promising innovation in nuclear energy is the development of Small Modular Reactors (SMRs). Companies like NuScale and TerraPower are leading efforts to commercialize SMRs, which offer flexible deployment and lower upfront costs.

A report from the U.S. Department of Energy (DOE, 2023) highlights that SMRs can provide 300–400 MW of power per unit, making them ideal for industrial clusters or AI-driven data centers.

Cost Competitiveness

While traditional nuclear plants require substantial capital investment (typically exceeding $10 billion per reactor), SMRs significantly lower these barriers. According to MIT’s Energy Initiative (2024), due to their modular design, SMRs could reduce construction costs by 30–50% and lower operational expenses.

Additionally, given AI and robotics’ high power needs, companies are willing to enter long-term power purchase agreements (PPAs), making nuclear more financially viable.

Investment Risks and Considerations

Regulatory Challenges

Investors must be aware of regulatory hurdles associated with nuclear energy. While the Nuclear Regulatory Commission (NRC) has streamlined approval processes for SMRs, permitting still takes 5–7 years.

Public Perception and Policy Uncertainty

Nuclear energy remains controversial. Despite technological advancements, public skepticism persists, driven by past incidents like Chornobyl and Fukushima. However, increasing power shortages may shift public opinion toward nuclear solutions.

Competition from Renewable Energy

While nuclear offers consistent baseload power, renewables are improving in storage and efficiency. Companies like Tesla and NextEra Energy are developing grid-scale battery solutions that could mitigate nuclear’s advantages over time. Investors should consider hybrid energy strategies, where nuclear complements renewables rather than competing against them.

Additional Considerations for Industrial Investors

Beyond nuclear, other solutions for future energy security include microgrids, industrial energy storage, and AI-driven energy management systems. Companies investing in these technologies are well-positioned to capitalize on the shift toward smart, autonomous industrial power systems.

Microgrid investments are gaining traction, allowing facilities to operate independently of the national grid when necessary. AI-driven predictive energy analytics also help companies optimize energy usage, reducing peak load demand and operational costs.

Conclusion: The Path Forward for Industrial Investors

Future-proofing industrial spaces requires a proactive approach to energy planning. As AI, robotics, and automation drive unprecedented power demand, investors must assess risks and opportunities in energy infrastructure.

Nuclear energy—particularly SMRs—presents a viable path to securing long-term, stable power. However, investors must navigate regulatory challenges and evolving public sentiment. Those who position themselves early in nuclear-backed industrial developments will likely gain a competitive edge as energy security becomes a key differentiator in the industrial real estate and manufacturing sectors.