The Chicagoland Office Market – Sep 18, 2024

The Chicago office market is experiencing significant shifts, marked by changing dynamics in leasing, sales, and tenant strategies. A key development is the impending entry of FRI Investors, a Florida-based firm led by CEO Michael McCloskey, into the local office market. The firm is poised to acquire a distressed and deeply discounted office tower at 70 West Madison Street in the Loop for just under $100 million, or about $70 per square foot. This price point represents a staggering 73% discount from the office building‘s 2014 valuation of $375 million.

This acquisition highlights the current challenges facing downtown office landlords. The 1.4 million-square-foot building, one of the tallest in Chicago, was built in 1981 and has seen its occupancy decline from 90% in 2014 to just 68% recently, with its largest tenant, CIBC, occupying over 116,000 square feet. Financing issues could still complicate the transaction, as the building’s current owners face a $276 million foreclosure lawsuit following a missed payment on a $305 million loan issued in 2018. Should the deal go through, it may resolve the foreclosure and potentially stabilize this asset in a market that has seen its fair share of distress.

The distressed sale is a clear indicator of the challenges downtown Chicago office properties face due to the shift to remote work, rising interest rates, and declining property values. However, this situation also presents opportunities for investors like FRI, who see potential in Chicago’s long-term recovery. Although FRI’s plans for the 70 West Madison property are not yet known, the building’s deeply discounted price may allow for investments in updates and tenant improvements, crucial steps in attracting new occupants in the post-pandemic office environment.

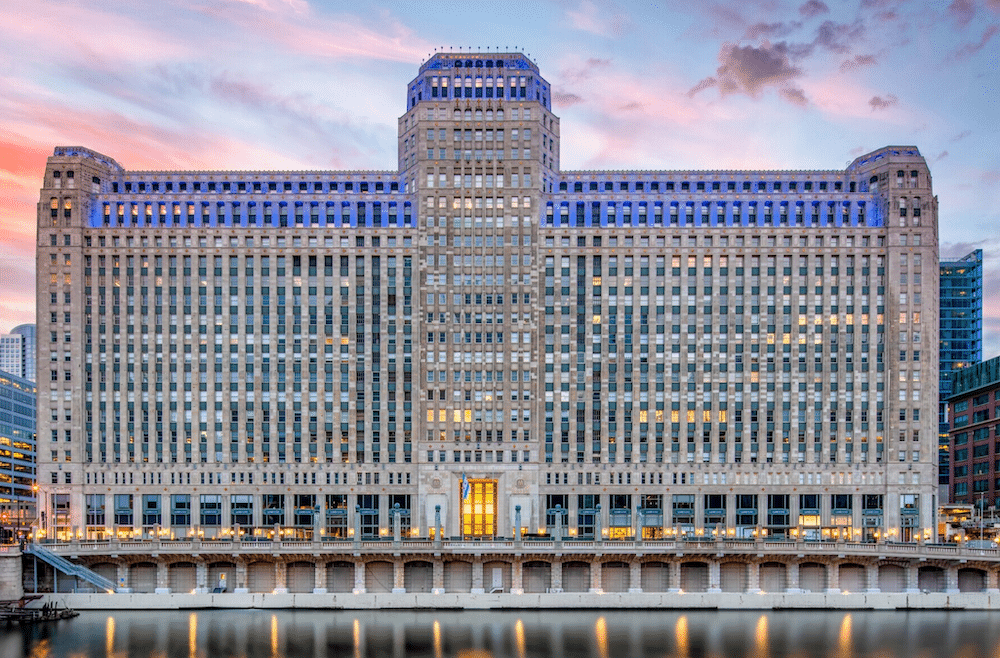

While some properties in the Loop struggle with vacancies and financial difficulties, other areas in Chicago are witnessing a more optimistic outlook. Medline Industries, a medical supply giant based in Northfield, has bucked the trend of companies reducing their office space by expanding its downtown Chicago presence. The company recently signed a long-term lease for an additional 110,000 square feet at the Merchandise Mart, making it one of the largest tenants in the riverfront property. This expansion brings Medline’s total office space at the Mart to 161,000 square feet, reflecting its continued growth and commitment to maintaining a strong downtown presence.

Medline’s decision to double down on its Chicago footprint comes as a welcome boost for the downtown office market, where landlords have been grappling with record-high vacancy rates. Vornado Realty Trust, the owner of the Merchandise Mart, recently invested approximately $70 million in extensive renovations and new amenities to attract tenants in a highly competitive market. This investment is starting to pay off, as evidenced by Medline’s expansion and the building’s other high-profile tenants, including Motorola Mobility and Conagra Brands.

The office market in Chicago is currently a tale of two trends: while some office towers face foreclosures and distressed sales due to changing work patterns and financial pressures, others like the Merchandise Mart thrive by adapting to new tenant needs. Medline’s expansion and the growing interest from investors like FRI highlight a nuanced recovery in downtown Chicago, driven by companies and investors willing to bet on the city’s office market rebound.

Notably, this dichotomy is also seen in how businesses approach office space post-pandemic. While some companies are scaling back on physical office presence, others are investing in more substantial office environments to foster collaboration and growth. Medline’s strategy, which emphasizes the importance of space for employee well-being and corporate culture, contrasts with the broader trend of office downsizing, showcasing a diverse set of strategies at play in Chicago’s evolving office market.

The ongoing changes in the Chicago office market underscore a transitional period for commercial real estate in the city. With companies like Google and JPMorgan Chase making substantial commitments to office space and investors like FRI exploring opportunities, the market signals a cautious optimism despite current challenges.